Understanding Long Term Care Insurance

Before you start planning for long term care, it’s important to understand the basics.

What is long term care?

Long term care (LTC) refers to a range of services over an extended period that aren’t covered by health insurance. Designed to help people with personal care and daily activities, it is for individuals who are unable to fully care for themselves due to chronic illness, disabilities, cognitive issues, or conditions that otherwise limit their ability to perform everyday tasks independently.

Who provides care?

LTC can be provided in various settings, including nursing homes, assisted living facilities, adult day care centers, and even at home with the assistance of professional caregivers or family members.

What does LTC cost?

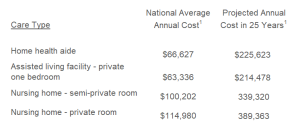

Costs for LTC vary considerably and are based on where you live, your care needs, and how long you need services. But without careful planning, LTC expenses can quickly deplete a retirement nest egg:

Long Term Care Insurance Provides Options

There are many ways to pay for care when you need it and where you’d like to receive it.

It’s important to note that these are national averages. Current annual costs for upscale assisted living facilities can exceed $240,000.1 It’s essential to research costs in your specific area and consult with an Advisor to understand your care options.

How can LTC Insurance Help?

Costs for LTC services are typically not covered by traditional health insurance, Medicare, or Medicaid. If you need LTC services, you’ll have to pay for it out-of-pocket in most states. LTC insurance can help mitigate these care costs with coverage for care in a variety of places, including your home. It can help protect your savings and also gives you more choices for care.

What are the premiums for LTC Insurance?

Your LTC insurance premium is dependent on a number of factors including:

- Your age and health. LTC premiums are more affordable the younger and healthier you are.

- Your gender. Women usually pay more than men due to their increased life expectancy and greater likelihood of filing a claim.

- Marital status. Premiums are generally lower for those who are married.

- Coverage amounts and features. You’ll pay more for higher limits, inflation protection, shorter elimination periods, and fewer restrictions on the types of care covered.

- In addition to an exclusive alumni discount, you may be eligible for spousal and preferred health discounts.

In 2023, on average, a 60-year-old man buying a traditional $165,000 policy with a 3% compound inflation rider would typically pay about $2,100 per year for coverage . A woman of the same age would pay $3,600 for the same policy.2 These premium averages are for “Select” health. If you are in “Preferred” Health, you may benefit from better rates.

What are the different types of LTC Insurance?

Today there are many LTC insurance solutions, but these three are the most popular. Each type of coverage has merits worth considering:

- Traditional LTC insurance. Also known as standalone LTC insurance, traditional policies exclusively cover LTC expenses in your home or a care center. Traditional plans typically provide the most robust LTC benefits, with almost all policies covering a combination of care at home and in an assisted living facility, nursing home, or adult day center.

- Hybrid Life Insurance. Also known as linked-benefits, these plans pair LTC insurance with life insurance. Linked benefit premiums are pre-paid as a lump sum (or over five-to-20 years) and are guaranteed to remain level. LTC benefits may be more limited than those of traditional LTC insurance, but your beneficiaries will inherit any partial or unused benefits.

- Life Insurance with an LTC Rider. When you purchase a life insurance policy, you can add an LTC rider that lets you use some of the life insurance policy’s death benefit to pay for LTC needs while you’re still living. This can be more affordable than purchasing a linked-benefit policy, but LTC benefits are even more limited.

How do I apply for LTC Insurance?

You’ll need to complete an application and answer health questions. Your doctors will provide medical records, and you may be asked for an interview.

You can choose the benefit amount you’d like to receive daily or monthly, up to a lifetime maximum amount or for a certain number of years. You will also choose a waiting period before benefits begin, known as the “elimination period.” A typical elimination period is 90 days but they generally range from 30-180 days. You can further tailor your policy with a number of additional riders.

Is there inflation protection?

Inflation protection is one of the most important considerations when shopping for LTC insurance. An inflation rider helps ensure that your coverage keeps pace with the rising costs of LTC services over time. This is critical as care costs continue to soar.

An inflation rider increases your benefit by a fixed percentage each year for a specified period, and also increases the lifetime maximum proportionately. All stand-alone LTC policies must offer inflation protection, usually with several different options, ranging from 1% to 5%. You can choose between a simple or compound rider. Of note, hybrid policies don’t always include an inflation protection option.

While an inflation rider is important, it can increase your premium significantly. Experts sometimes recommend opting for a slightly lower benefit amount in exchange for inflation protection that will help preserve the real value of your policy. An Advisor can walk you through various options.

What is Shared Care?

Some insurers offer a “shared care” option for couples. When both spouses purchase policies, they can share the total amount of coverage, which enables one spouse to draw from the other’s pool of benefits once he or she reaches the limit on his or her policy. Some policies offer a third pool of money that each spouse may access after exhausting their individual coverage. Premiums are higher for shared care policies, but they can provide the peace of mind of knowing you can access multiple benefit pools.

At What Age Should I purchase LTC insurance?

The sooner you decide to plan for LTC care, the more options you’ll generally have—and the more affordable LTC insurance will be. LTC insurance premiums increase each year you wait, and if you wait too long, you risk developing medical conditions that could preclude you from qualifying at all. Insurers decline about 20% of applicants between ages 50 and 59, but declinations jump to nearly 50% for those who apply after age 70.3

For most people, the optimal time to start exploring your LTC options is when you’re in your mid-50s when, if you’re healthy, you’ll benefit from significant premium savings. If you wait until age 65 to buy a policy, your premiums could be double what they’d be if you had purchased at age 55.

Can I use my Health Savings Account to fund LTC premiums?

Since LTC insurance premiums are considered a medical expense, you can use your HSA to pay premiums on tax-qualified LTC insurance. Traditional LTC insurance is considered tax-qualified as are most hybrid LTC policies.

The amount you can withdraw tax-free increases with age (and changes each year). If you and your spouse both have LTC policies, you can both use tax-free funds from your HSA to pay premiums, up to the aged-based maximum for each of you.

How are LTC benefits triggered?

LTC policy benefits begin when you have severe cognitive impairment, such as Alzheimer’s Disease, that makes it impossible for you to safely live independently, or you are unable to perform two of the six activities of daily living (ADLs). The ADLs are: bathing, caring for incontinence, dressing, eating, toileting, and transferring (getting in and out of bed or a chair).

You must be expected to need care for at least 90 days. And, you must satisfy the elimination period before benefits begin. During the elimination period, you are responsible for covering expenses related to your care.

When you file a claim, the insurance company will review medical documents and may require an independent evaluation. It must also approve your plan for care. Once your claim is approved, the insurer will either pay the care facility or provider directly or reimburse you each month for covered expenses paid out of pocket.

Which is the best LTC insurance company?

The best LTC insurer is one that meets your needs and budget given your health, therefore providing you with the best value.

Premiums and plan benefit options vary widely among insurers, so it’s wise to work with an independent LTC Advisor who is appointed with a variety of carriers. Our Advisors will:

- select insurers that are most likely to accept you based on your health

- find you the best value policy that falls within your budget

- explore alternative options if you can’t qualify or aren’t interested in traditional LTC insurance

How Do I get Started?

It’s easy to connect with an Advisor who can educate you about the process and provide you with options. Advice is complimentary—there are no fees and there is no obligation. If you already have LTC insurance, we’re happy to assess your current coverage for any gaps.

You can select from traditional LTC plans, as well as a variety of alternative solutions including hybrid products, short term care plans, and LTC annuities. You’ll receive detailed plan illustrations, and if you decide that LTC insurance is for you, we’ll walk you through the application process. If you need to file a claim, we’re here to help with that too.

LTC planning is complicated—both emotionally and financially. Our Advisors have a wealth of experience and can help you formulate a plan that will bring you and your family peace of mind.

1 Mutual of Omaha 2023 Cost of Care report. Projected future cost calculated using 5% compound inflation.

2 Long Term Care Policy Costs, 2023, American Association for Long-Term Care Insurance.

3 American Association for Long-Term Care Insurance, accessed December 2023.